-

Products and Systems

Products and Systems

Vinidex manufacturers and supplies a broad range of products & systems to suit a range of applications.

-

Solutions

Solutions

Vinidex’s products and systems are versatile and can be used in a variety of markets and applications.

- Resources

-

Top Trends in PVC Supply for 2025 What You Need to Know

As we look ahead to 2025, the dynamics of the PVC supply market are poised for significant evolution. The demand for polyvinyl chloride (PVC) persists across various industries, including construction, packaging, and automotive, making it imperative for stakeholders to stay informed about the underlying trends that will shape this essential material's availability. Understanding the changing landscape of PVC supply will not only guide producers and manufacturers in strategic decision-making but also enable them to navigate challenges such as fluctuating raw material costs and shifting regulatory frameworks.

In recent years, the PVC supply chain has experienced disruptions due to economic fluctuations and global events, highlighting the need for resilience and adaptability within the industry. This introduction sets the stage for a deeper exploration of emerging trends, including advancements in sustainable production methods, innovations in recycling technologies, and the impact of changing consumer preferences on PVC usage. By examining these critical factors, we aim to provide a comprehensive overview of what to expect in the PVC supply landscape heading into 2025, equipping businesses and professionals with the insights necessary to thrive in an ever-evolving market.

Key Factors Driving PVC Supply Trends in 2025

The PVC supply landscape is expected to undergo significant transformations as we approach 2025. A key factor driving these trends is the increasing demand for sustainable materials within the construction and automotive sectors. According to a recent market report by ResearchAndMarkets, the global demand for PVC is predicted to reach over 50 million metric tons by 2025, with a substantial push from eco-friendly formulations and recycling initiatives. This shift is largely influenced by regulatory policies promoting environmentally responsible materials, prompting manufacturers to innovate and adapt their production processes.

Another critical factor affecting PVC supply trends is the volatility in raw material prices, especially those derived from fossil fuels. As highlighted in the International Energy Agency's forecast, the transition towards renewable energy sources may stabilize or even reduce dependency on traditional feedstocks, thereby impacting the production cost of PVC. Furthermore, ongoing geopolitical tensions and supply chain disruptions have emphasized the need for localized sourcing strategies. Companies are increasingly looking towards vertical integration and diversification in their supplier networks to mitigate risks and ensure a steady supply of raw materials, ultimately driving trends in the PVC market through 2025.

Emerging Technologies Impacting PVC Production Efficiency

Emerging technologies are fundamentally reshaping PVC production efficiency, paving the way for a more sustainable and cost-effective future. Innovations such as enhanced recycling methods, advanced polymerization techniques, and IoT-enabled manufacturing processes are set to revolutionize how PVC is produced. These developments not only improve material properties but also significantly reduce energy consumption and waste generation, aligning with global sustainability goals.

To maximize the benefits of these emerging technologies, manufacturers can adopt several practical tips. First, investing in automation and smart sensors can streamline production lines, allowing for real-time monitoring and minimizing downtime. Second, integrating closed-loop recycling systems can help reclaim PVC waste, transforming it into high-quality raw materials for new products. This not only cuts costs but also enhances the reputation of companies committed to sustainability.

Moreover, leveraging data analytics can provide insights into production efficiencies and areas for improvement. By analyzing metrics such as energy usage, output quality, and maintenance schedules, manufacturers can identify trends and optimize their processes accordingly. Staying ahead in adopting these technologies will be crucial for competitive advantage in the evolving PVC supply landscape.

Sustainability Initiatives Shaping the PVC Industry Landscape

Sustainability is becoming a crucial component in shaping the PVC industry, with companies increasingly adopting green initiatives to reduce their environmental footprint. According to a report by Mordor Intelligence, the global demand for sustainable PVC solutions is projected to grow at a CAGR of approximately 6% from 2021 to 2026. As legislators push for stricter environmental regulations, the industry is responding by investing in innovative recycling technologies and utilizing bio-based materials. This shift not only meets regulatory requirements but also aligns with consumer preferences, as studies indicate that over 70% of consumers prefer products from companies that demonstrate a commitment to sustainability.

Moreover, a recent study by Research and Markets highlights that the adoption of circular economy practices in the PVC sector can significantly reduce waste, with recycling rates of PVC reaching up to 43% in certain regions. Companies are exploring various avenues such as chemical recycling, which can convert post-consumer PVC back into raw materials, thus minimizing reliance on virgin materials. This not only helps in addressing waste management challenges but also positions companies favorably in a competitive market where sustainability is becoming a key differentiator. As the PVC landscape continues to evolve, it is clear that sustainability initiatives will play a pivotal role in driving innovation and growth within the industry.

Regional Market Dynamics Influencing PVC Supply Chains

The regional market dynamics play a crucial role in shaping the PVC supply chains as we look toward 2025. Different regions exhibit unique consumption patterns and production capabilities that significantly impact global PVC availability. For instance, North America has witnessed a surge in demand driven by construction and automotive industries, necessitating a robust response from local producers. In contrast, Asian markets, particularly Southeast Asia, are experiencing rapid urbanization, which intensifies the need for PVC in infrastructure development. This divergence in regional demands compels manufacturers to strategically optimize their supply chains to cater to specific market needs.

Additionally, geopolitical factors and trade policies can greatly influence PVC supply chains. Regions may face varying levels of tariffs, trade restrictions, or incentives that affect both imports and exports. For example, changes in regulatory frameworks could push certain regions to seek alternative suppliers or shift production locations altogether. Moreover, supply chain integrity is affected by local economic conditions, labor markets, and environmental regulations, all of which must be navigated to ensure a steady PVC supply. As these dynamics evolve, stakeholders in the PVC market must remain agile and informed to adapt their strategies effectively and maintain competitiveness in the global landscape.

Top Trends in PVC Supply for 2025

Forecasted Demand for PVC in Key Sectors and Applications

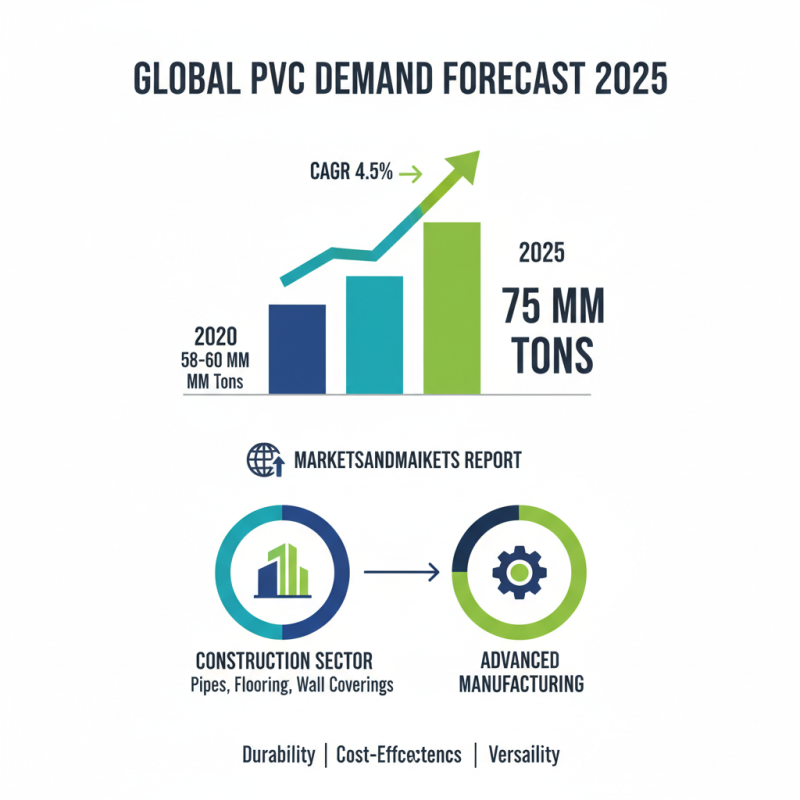

The forecasted demand for Polyvinyl Chloride (PVC) in 2025 reflects a robust growth trajectory across several key sectors, driven largely by advancements in manufacturing technologies and increasing applications. According to a recent industry report from MarketsandMarkets, the global PVC market is anticipated to reach approximately 75 million metric tons by 2025, growing at a compound annual growth rate (CAGR) of around 4.5%. This increase is primarily spurred by the construction sector, where PVC is favored for its durability and cost-effectiveness in applications ranging from pipes and fittings to flooring and wall coverings.

Additionally, the automotive and consumer goods sectors are also projected to significantly contribute to PVC demand. The automotive industry alone is expected to witness a growth rate of about 6% annually, as manufacturers increasingly utilize PVC for interiors and exteriors, given its versatility and lightweight properties that enhance fuel efficiency. Meanwhile, an emerging trend in sustainable practices is prompting more companies to explore recycled PVC options, ensuring that the demand aligns with environmental goals while still meeting performance standards. Thus, stakeholders in the PVC market must prepare for evolving trends and increased competition as 2025 approaches.

Related Posts

-

Why Choose HDPE Water Pipe for Your Next Plumbing Project?

-

Understanding the Benefits and Applications of HDPE Plastic Pipe in Modern Infrastructure

-

Why Poly Water Pipe is the Best Solution for Your Irrigation Needs

-

The Ultimate Guide to PVC Pipes and Fittings: Exploring Benefits, Standards, and Market Trends

-

Understanding the Essential Role of PE Pipe Fittings in Modern Plumbing Systems

-

Exploring the Versatility of Black Plastic Pipe in Modern Infrastructure Solutions